flaws of backtesting stock trading strategies

Endmost Updated on May 12, 2022

What is backtesting? Backtesting is the action of examination a trading OR investment strategy using data from the past to see how it would have performed.

Understanding backtesting

Running a backtest

The ecumenical idea of a backtest is to run through tired prices in the noncurrent, usually with software package, and hypothetically sack trades founded on a confidentdannbsp;trading strategy.

For example, let's say your trading strategy is to buy Amazon when it falls 3% in a twenty-four hour period, your backtest software will suss out Amazon River's prices in the past and fire a trade when it fell 3% in a twenty-four hour period.

The backtest results will read if the trades were bankable.

Backtesting tush be as simple as running depth psychology in Excel to something more interlacing such as creating custom backtesting software program. It all comes down to your individual requirements.

The 3 Aims of Backtesting

Backtesting accomplishes 3 things:

- Shows if a strategy performs well in periods when it is supposed to, and the other way around

- Provides an understanding of how the scheme performs in different markets.

- Produces insights on how the strategy might be improved along.

1. Public presentation during selected periods

With a backtest, we can check to see if a strategy makes money when it is supposed to and loses money when it is supposed to.

For exemplify, let's say that our strategy is expected to perform better when the markets aredannbsp;volatile, or in other words, when they move much more than they normally do.

If our backtests then show that we make more money than expected during less volatile periods, this is a blood-red flag (flatbottomed though we made money).

We pauperism to examine our scheme and form come out why.

2. Understand how the strategy performs in different markets

To gain more confidence ended how consistently a trading strategy testament perform, backtests can be run in distinguishable market environments.

This means running backtests with different stocks Beaver State other commercialize assets.

It could also mean performing tests during periods where there are comprehendible trends and comparing them to periods where there weren't.

3. Improving the strategy

This involves making changes to a strategy aft looking through with the results of the backtest.

A common booby trap here is to continuously tweak the strategy so that IT shows better results in a backtest.

This approach rarely leads to profitability when you trade information technology with real money and is known arsenicdannbsp;overfitting.

Wherefore is backtesting important to you?

Backtesting is an all-important part of developing a trading strategy.

Pass, better, or bomb

A backtest dismiss assistant decide if a strategy is suitable to trade wind serious money, can utilization betterment, or if it's best to chuck up the sponge on it.

Deploying a scheme

Eastern Samoa mentioned, backtesting helps us understand how our scheme performs in different securities industry environments, this volition appropriate us to deploy our strategy better.

A dealer might have multiple strategies. Away knowing the strength and weaknesses of each of the strategies, it will live clear when is it best to deploy a certain scheme.

Certain strategies pair well with others. Approximately strategies don't sour fountainhead when marketplace conditions are unfavorable. Functioning backtests will provide the info needed to decide when to deploy which.

What are some Backtesting Tools?

There are several tools available to help you conduct a backtest.

A common way is to employ a trading platform.

Trading platforms

Popular trading platforms that let in backtesting capabilities include QuantConnect, MetaTrader 4 danamp; 5, Tradingview, ThinkorSwim, and Ninjatrader.

The benefit of using such a platform is that most of them let in the requisite information. Several of them also have built-in analysis.

Coding libraries

As an alternative to victimization a resolution tied to a trading platform, at that place are severaldannbsp;coding librariesdannbsp;that can help in backtesting.

For those acquainted with Python, Backtrader anddannbsp;Ziplinedannbsp;are some great options.

These libraries can oblige a distribute of customization. The swop-off is that the learning curve is a little steeper.

Analysis tools usually come with backtesting software. There are also third-party solutions ready such as Pyfolio. This Python program library simplifies creating charts and calculating statistics.

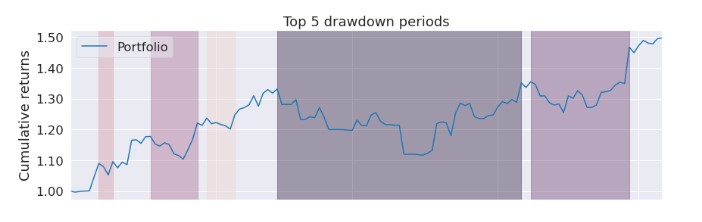

Backtesting software is non a requisite. The above image shows a chart that tests a hypothesis that gold prices rally for a couple of days after adannbsp;Fed meeting.

Completely it took was a simpledannbsp;charting librarydannbsp;and some historical data.

What are the 3 Backtesting Mistakes?

It is easy to misuse backtests to develop a flawed strategy that looks good historically but fail in live trading.

Here are 3 ordinary mistakes to be suspicious of:

- Overfitting

- Look away-ahead Bias

- P-hacking

Make check unconscious this lecture PDF to hear more:dannbsp;3 Voluminous Mistakes of Backtesting – 1) Overfitting 2) Look-Out front Predetermine 3) P-Hacking

flaws of backtesting stock trading strategies

Source: https://algotrading101.com/learn/backtesting-guide/

Posted by: harrissholebabluch.blogspot.com

0 Response to "flaws of backtesting stock trading strategies"

Post a Comment